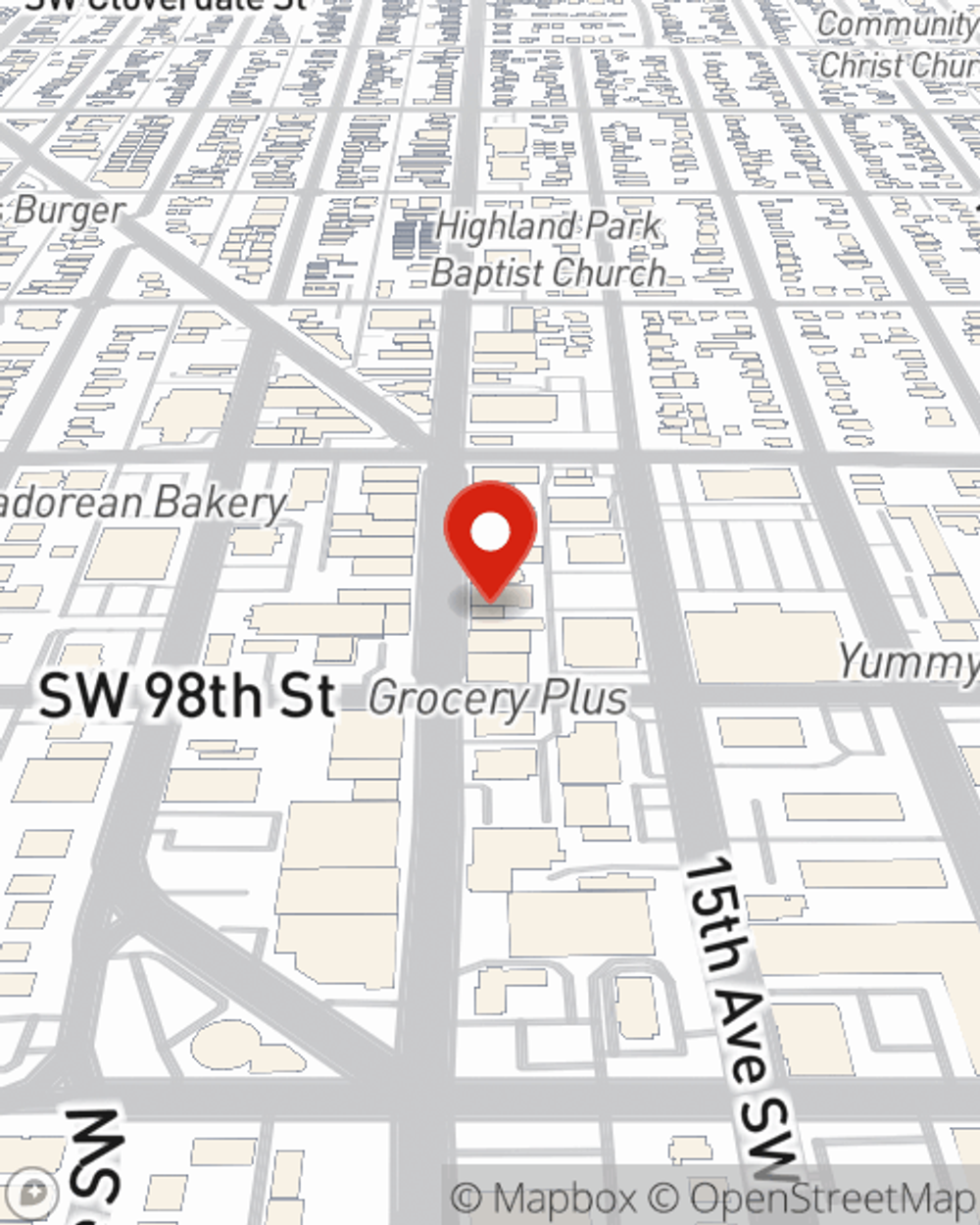

Homeowners Insurance in and around Seattle

A good neighbor helps you insure your home with State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you catch your breath, unwind and slow down. It’s where you build a life with your favorite people.

A good neighbor helps you insure your home with State Farm.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Don't Sweat The Small Stuff, We've Got You Covered.

Heather Proctor will help you feel right at home by getting you set up with secure insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect treasured items like your favorite chair.

Don’t let fears about your home stress you out! Reach out to State Farm Agent Heather Proctor today and explore how you can save with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Heather at (206) 935-3922 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.

Heather Proctor

State Farm® Insurance AgentSimple Insights®

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.